Paycheck Stub Law

Pay stubs are also called “wage statements” and are a common target of wage and hour lawsuits. If they are deficient, the evidence is directly on the face of the documents. When utilizing pay stubs, the plaintiffs suing in a class or representative action could subject your company to steep penalties.

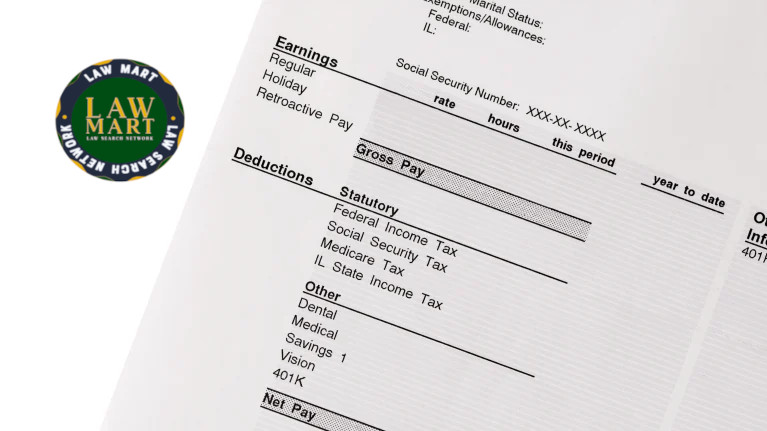

What is the Pay Stub Requirements

Under Section 226.2, nine items must be on every pay stub:

- Gross Wages Earned During the Pay Period

- Total Hours Worked During the Pay Period

- Number of Piece-Rate Units Earned and Piece-Rates, If Any

- All Deductions from Wages

- Net Wages Earned During the Pay Period

- Inclusive Dates of the Pay Period (Start and End Dates)

- Employee’s Name and Last Four of SSN, or Employment ID Number

- Full Name and Address of Legal Entity of Employer

- All Applicable Hourly Rates During the Pay Period and Amounts Paid at Each Hourly Rate

California’s wage statement requirements are extensive. Nevertheless, our experienced employment attorneys can review your company’s statements and advise you on any changes needed to comply with the laws.

We Are Here For You 24/7

The faster you speak to a Business Litigation Attorney the better. Waiting too long to file business cases can complicate your case. Make it easy on yourself. Call us to talk with an experienced business lawyer right away. Your call is confidential, and you’re FREE CONSULTATION with one of our business litigation attorneys at (310) 894-6440.

Lawyer Referral Service

If you are in need of a business litigation attorney to help you get appropriate compensation and medical care you deserve, you should contact an attorney today. Our experienced business litigation attorney will help you find the solutions you need for your legal issues.